- Release tax-free cash from your house with Equity Release Japanese Knotweed 5.13%

- All complex property types considered

- Free valuation

- Lower rates for 2025 as long term rates continue to plunge

- No monthly payments

- Help your family to buy another home

- Are you still paying a mortgage? No problems

- Continue to live in your own home

How much cash can I release?

You can borrow 65% of your home’s value. For example, if your house is valued at £180,000, you can get £117,000.

Concise Finance Customer Reviews

William from London

My lawyer told me my inheritance tax bill would be around £250,000. I got a lifetime mortgage to give money to my son and daughter so they could buy bigger homes, and we bought a house in the south of France for us all to use as a holiday home.

Mrs Shaw from Lancaster

I had an interest-only mortgage with Birmingham Midshires. The mortgage had come to the end of its term and they wanted the £127000 back I still owed them. My lifetime mortgage saved me from losing my home and the rate was close to what I paid before.

Non-Standard Property Home Index

Mrs Daly from Glasgow

My daughter lives in the States and does not have health insurance. My £30,000 lifetime mortgage paid the medical bills for her son’s birth and a year’s rent in advance for a new flat for the baby.

Mrs E from London

I was advised to get equity release from my East London home to minimise inheritance tax. My son and daughter used the money to pay down their mortgages. The interest rate on the equity release was so low it was close to their mortgage rate.

Mrs L from Nottingham

I had to pay a valuation fee and a solicitor’s fee, but no lender or broker fees for my lifetime mortgage. As I was divorcing my husband of 30 years the money went to him for his share of the house. I am happy now as I am secure, and I do not need to move from my home.

Julia A

My mother has dementia. With my solicitor and my power of attorney, I got equity release on my mother’s house to pay for specialist modifications for her comfort.

Equity Release Lenders

- Key Retirement

- One Family

- Lifetime Mortgage from L&G

Hard-to-mortgage property variants can include homes requiring essential repairs. In these properties, multiple third parties are living in an annexe, right to buy – properties in England, Wales and Northern Ireland, crofted houses and properties with leased solar panels.

Difficult to finance property types can include eco houses and modern construction methods, properties with any external treatment applied to the roof after construction, properties with a minimum floor area of 30 square metres, studio flats outside the M25, and properties where the flat is accessed via a deck or balcony.

Challenging to mortgage home variants can include properties with land in addition to the domestic grounds up to a maximum property size of five acres, where the land is for everyday domestic use, properties with a single annexe or another self-contained part of the property, use of the land and any outbuildings for a small amount of personal commercial use., properties that have solar farms or a large number of wind turbines on the land and properties in coastal areas that may be affected by erosion.

Tough to mortgage home titles can include properties with a sinking fund of 7% or more of the property sale price when the property is sold, leasehold properties with a short lease, typically less than 70 years, or a defective lease, properties with structural problems, thatched buildings and missing planning permission or building regulations approval.

Towns where Equity Release Japanese Knotweed is popular

- Wimbledon

- Epping

- Blackrod

- Burton Latimer

- South Brent

- Verwood

- Wallingford

- Sale

- Worksop

- Aspatria

- Moreton-in-Marsh

- Battle

- Workington

- Grantham

- Burford

- Colne

- Fleet

- Kingsbridge

- Aldeburgh

- Arlesey

- Ealing

The Equity Release Japanese Knotweed mortgage lender will want to know if the property is a Freehold terraced or Leasehold house and if the resident is an Assured shorthold tenancy tenant.

- Japanese Knotweed Map

- Equity Release Schemes

- Key Retirement Interest Only Lifetime Mortgage

- Nationwide Retirement Mortgage Broker

- Single Skin Brickwork Later Life Mortgages

- Manchester Building Society Over 55 Mortgage

Equity Release Rates: A Comprehensive Guide

Equity release has become an increasingly popular financial option for homeowners, especially those approaching or retiring. It provides a way for property owners to unlock the value tied up in their homes without selling or moving. This guide offers an in-depth look at various equity release rates and their relevance for potential borrowers.

Lifetime Mortgage Rates

A lifetime mortgage is the most common type of equity release. Homeowners can borrow a portion of their home’s value, with the loan amount plus interest being repaid when they die or move into long-term care.

Understanding Lifetime Mortgage Rates

The interest rate associated with a lifetime mortgage determines how much the loan will cost over its term. These rates can vary based on:

- The lender: Different providers offer varying rates.

- Economic conditions: Prevailing interest rates can influence lifetime mortgage rates.

- The amount borrowed: Larger amounts might have different rates compared to smaller loans.

Fixed vs. Variable Rates

Lifetime mortgages can come with either fixed or variable interest rates.

- Fixed rates: The interest rate remains unchanged for a set period or the life of the loan. This offers predictability in terms of cost but might be higher initially than variable rates.

- Variable rates: These rates can fluctuate based on external benchmarks or conditions. They might offer lower initial rates, but there’s the risk of rates increasing in the future.

Interest Only Lifetime Mortgage Rates

With interest-only lifetime mortgages, borrowers only pay the interest on the loan each month, with the principal repaid at the end of the term.

Benefits and Considerations

Interest-only options can offer lower monthly payments since the principal is not being reduced. However, borrowers need to plan for repaying the loan amount at the end of the term.

Comparing Interest Rates

When considering this option, it’s vital to compare rates from different lenders. Look for competitive interest-only lifetime mortgage rates and consider potential rate changes if opting for a variable rate.

Interest Only Retirement Mortgage Rates

Unlike standard lifetime mortgages, interest-only retirement mortgages are designed specifically for retirees. They offer the possibility to borrow in retirement and make interest payments, preserving the equity in the home.

Factors Influencing Rates

- Age of the borrower: Older borrowers might get different rates due to the perceived shorter loan duration.

- Property value: Higher value properties might attract more favourable rates.

- Income: Since borrowers need to demonstrate the ability to pay the interest, their retirement income can influence rates.

Retirement Mortgage Rates

Retirement mortgages are broader than interest-only products and can include both interest-only and repayment options. They cater to retirees who might have diverse income streams.

Choosing the Right Product

When considering retirement mortgage rates, it’s essential to match the product with your financial needs and future planning. Look beyond just the headline rate and consider any associated fees, the flexibility of the product, and repayment terms.

Pensioner Mortgage Rates

Pensioner mortgages cater to older borrowers, usually those over 65, and can include various product types, from standard repayment mortgages to interest-only options.

Rate Implications for Older Borrowers

Age can play a role in the rates offered. Sometimes, pensioner mortgage rates might be higher due to the perceived increased risk associated with older age. However, with more providers catering to older borrowers, competitive rates can be found.

RIO Mortgage Rates

Retirement Interest Only (RIO) mortgages are a relatively new product. They allow borrowers to make interest payments indefinitely, with the loan amount repaid from the property’s sale, typically after death or moving into care.

Advantages of RIO Mortgages

RIOs can be attractive due to their potential for lower monthly payments and the preservation of home equity.

Assessing RIO Mortgage Rates

Like all mortgage products, it’s essential to shop around and compare RIO mortgage rates from various providers. Consider both the rate and any associated fees or charges.

Release Equity: Factors Influencing Rates

When homeowners decide to release equity from their homes, various factors can influence the rates they’re offered.

Property Location and Value

The property’s location and its current market value can significantly impact the rates offered by lenders.

Age and Health of the Borrower

Older borrowers or those with health issues might access more favourable rates due to the perceived shorter loan duration.

Retirement Interest Only Mortgage Rates

Retirement interest-only mortgages offer a way for retirees to access property wealth while only covering the interest payments during their lifetime.

Rate Considerations

When assessing RIO mortgage rates, consider:

- Term of the loan: Is there a set term, or is it indefinite?

- Rate type: Is the rate fixed or variable?

- Fees: Are there any application or ongoing fees?

Comparison with Other Products

When considering a RIO, it’s beneficial to compare it with other equity release products, considering both the rates and the product features.

In conclusion, understanding the different equity release rates and products is essential for homeowners considering tapping into their property’s value. By comparing rates and understanding the implications of each product, homeowners can make informed decisions that best suit their financial needs and future plans.

- Hanley Economic Building Society Pensioner Mortgage Calculator

- nationwide mortgages for over 60s Retirement Mortgages Interest Only

- Contaminated Property Equity Release

- Equity Release Calculator Under 55

- Concrete Ex-Council Houses

- Key Advice Lifetime Interest Only Mortgage Rates 2025

Demystifying Japanese Knotweed in the UK

The Menace of Japanese Knotweed

Japanese knotweed, scientifically known as Fallopia japonica, has been recognized as one of the most invasive species worldwide. Originating in East Asia, it has now become a significant concern in the UK due to its rapid growth rate and ability to cause damage to infrastructure, natural habitats, and property values.

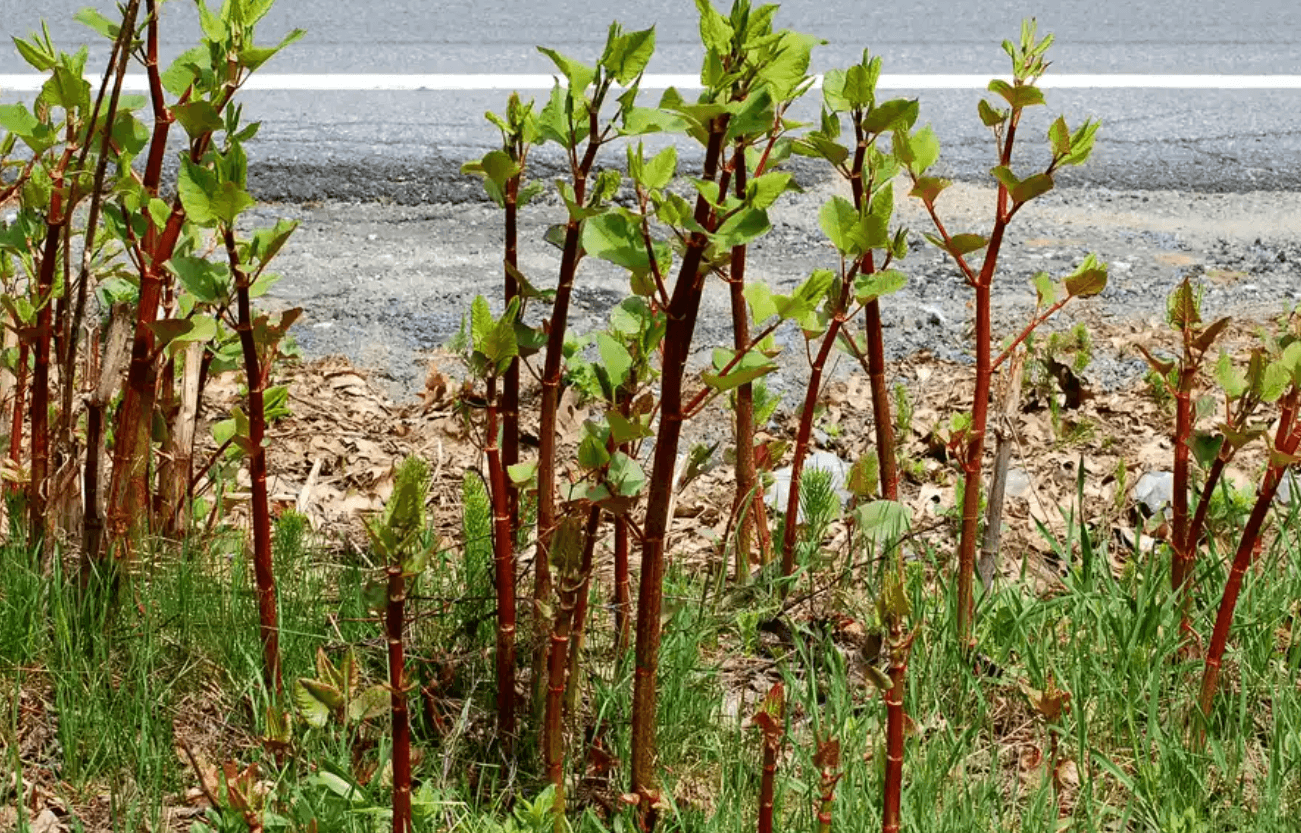

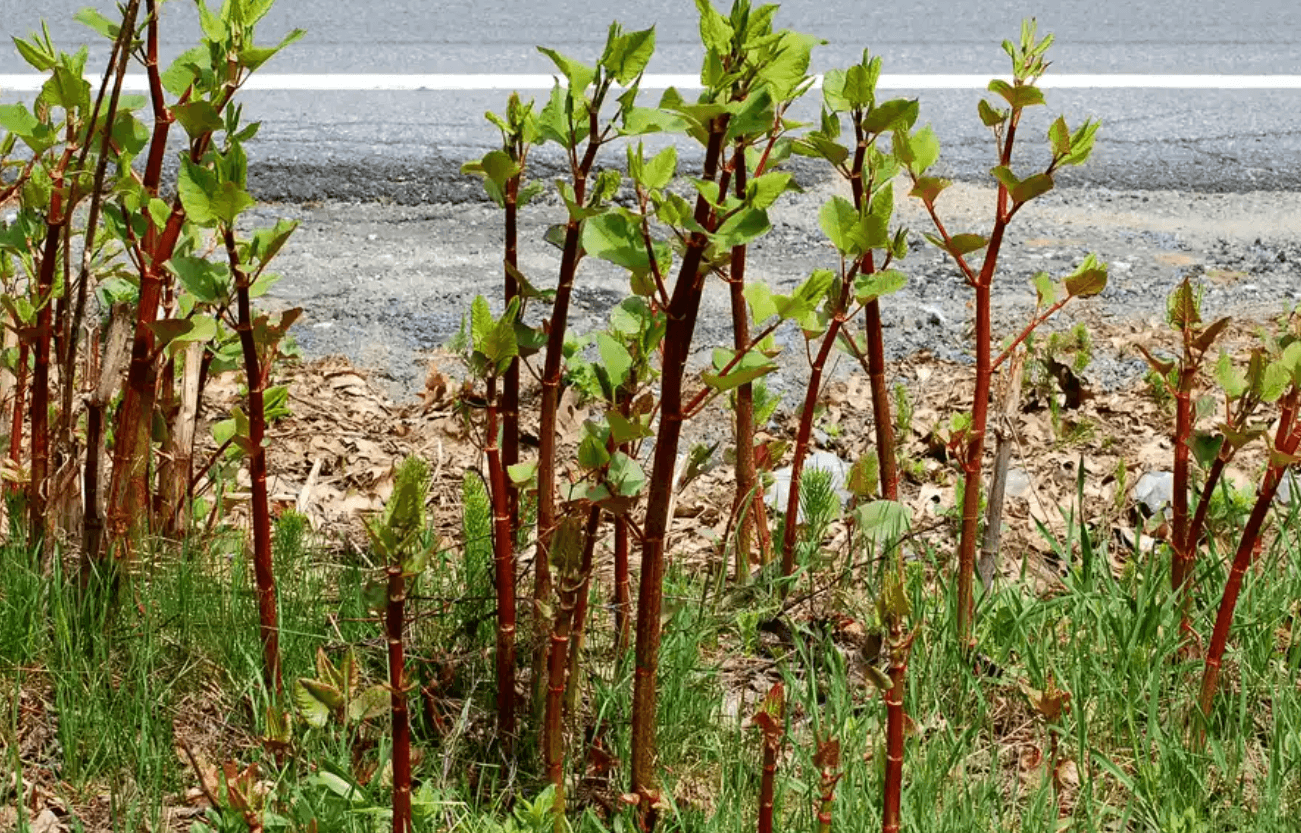

Japanese Knotweed Identification

To tackle this invasive plant effectively, one must first understand what does Japanese knotweed look like. It typically grows up to 2-3 metres in height, with bamboo-like stems, heart-shaped leaves, and tiny cream or white flowers that bloom in late summer. The plant spreads through its extensive network of rhizomes, which can extend several meters underground.

Japanese Knotweed Images

A simple online search for “Japanese knotweed pictures” or “Japanese knotweed flowers pictures” will provide a visual guide. However, the Royal Horticultural Society (RHS) also offers detailed images and weed identification guidelines on its website to help distinguish it from other common garden weeds in the UK.

Misconceptions about Japanese Knotweed

Some people mistake Japanese knotweed for other plants, such as plants that look like Japanese knotweed. This confusion can lead to unnecessary panic or neglect. For instance, the young Japanese knotweed can be confused with the likes of common weeds with yellow flowers or even other forms of knotweed like Chinese knotweed. So, it’s crucial to be sure of the identification before taking any measures.

The Impact of Japanese Knotweed

Property and Infrastructure

Japanese knotweed damage isn’t limited to the environment alone. Its rapid growth can exploit weaknesses in structures, leading to damage to pavements, drains, and even building foundations. Moreover, houses for sale in areas known for Japanese knotweed might experience a dip in market value, making it a matter of interest for property firms such as the Purple Property Shop and others.

Ecological

Japanese knotweed can choke local flora, reducing biodiversity. The dense growth can overshadow native plants, hindering their ability to photosynthesize and grow. Moreover, its vigorous growth leaves little room for native plants to thrive, thereby impacting the local ecosystem.

Legal Implications of Japanese Knotweed in the UK

Japanese knotweed UK law, under the Wildlife and Countryside Act 1981, has made it illegal to plant or cause the weed to grow in the wild. Furthermore, with the Anti Social Behaviour Crime and Policing Act 2014, local authorities can issue community protection notices for properties with uncontrolled growth of this weed.

Property Sales and TA6 Forms

When selling a property, owners are required to declare the presence of Japanese knotweed on the TA6 form. Failure to disclose this information can lead to legal disputes. Even if the weed is present in neighbouring properties, it’s a cause for concern and should be mentioned.

Japanese Knotweed Removal

Eradication of Japanese knotweed is not a straightforward process. Its resilient nature means that even after seemingly removing the plant, its rhizomes can lead to a resurgence.

DIY Methods

Many homeowners first think of using off-the-shelf solutions like Roundup concentrate, which contains glyphosate. Products like the Gallup glyphosate weedkiller have also been utilized. However, while they might suppress the growth temporarily, they may not offer a long-term solution.

Professional Removal

Japanese knotweed removal cost can vary based on the infestation’s extent and the chosen method of removal. Professional firms specializing in Japanese knotweed removal employ methods like deep excavation, herbicide application, and even the use of barriers to prevent its spread.

Public Awareness and Media Coverage

BBC Japan and other media outlets have covered the menace of Japanese knotweed, highlighting its impact on biodiversity, property values, and the environment. The RHS offers advice on its control and eradication, and Today’s Conveyancer has articles discussing its legal implications, especially concerning property sales.

Dispelling Myths

With so much discussion around Japanese knotweed, several myths have arisen. Some believe that you can get rid of the weed simply by using regular garden weed killers, while others think that Japanese knotweed seeds are responsible for its spread. In truth, it rarely produces viable seeds in the UK, and its spread is primarily due to rhizome fragments.

Collaborative Efforts for Eradication

It’s not just the responsibility of individual property owners. Organizations like DEFRA UK are actively involved in researching and finding sustainable solutions to the Japanese knotweed issue.

Local Societies and Awareness

Local societies like the Japan-Society work towards building awareness about various facets of Japanese culture and issues, including the environmental challenge posed by Japanese knotweed in the UK. Collaborative efforts and awareness are key to managing and eventually eradicating this invasive species.

Japanese Knotweed and UK’s Changing Landscape

While eradication efforts are ongoing, it’s essential to consider the broader implications of invasive species on the UK’s landscape. Japanese knotweed, among other invasive plants, poses a threat not just to biodiversity but also to the very fabric of urban and rural landscapes, from property values to the integrity of structures and natural habitats. By staying informed, taking collective action, and leveraging both traditional and innovative solutions, the UK can hope to address the Japanese knotweed challenge head-on.

- Age Partnership Comparison

- Nationwide Mortgages For Over 65S

- Cheap Studio Flats

- Mortgage No Early Repayment Charge

- BISF Equity Release From Property

- Saffron Building Society Equity Release Age

- Derbyshire Building Society Branches

- Contaminated Land Pensioner Mortgage No Credit Check

Understanding Lifetime Mortgage Interest Rates Over 60 in the UK

What is a Lifetime Mortgage?

For many homeowners in the UK, property is their most valuable asset. As a result, lifetime mortgages have become a popular financial product, allowing homeowners over the age of 60 to tap into the equity they have built up in their homes. This is particularly relevant for those seeking additional income in retirement or looking to manage significant expenses.

How does it work?

A lifetime mortgage is a long-term loan secured against the borrower’s property. Unlike conventional mortgages, there are no monthly repayments. Instead, interest accumulates over time, and both the loan and the interest are repaid when the homeowner either passes away, sells the property, or moves into long-term care.

Interest Rates for Those Over 60

Interest rates for lifetime mortgages can vary. Factors like the homeowner’s age, property value, and prevailing market conditions play a role. The Chelsea Building Society branches, along with other lenders, typically offer competitive rates for these products.

Giant Knotweed of Compounding Interest

One thing to note about lifetime mortgages is the compounding effect of interest. Just like the rapid growth and spread of invasive plants like giant knotweed, interest on a lifetime mortgage can accumulate quickly if left unchecked. It’s essential to understand the implications of compound interest and how it can impact the equity remaining in the home.

The Significance of Equity Release Rates Over 70

For homeowners over the age of 70, equity release can be even more appealing. This is due to the likely increase in property value over their lifetime and the potential for higher equity release amounts.

Weighing Up the Blue Flowered Weed of Equity Release

Equity release is not a decision to be taken lightly, and it’s essential to consider the pros and cons. Just as a garden may have both beautiful blue flowered weeds and troublesome knot weed, the decision to release equity has its advantages and drawbacks.

Weed Flowers of the Financial World

As with understanding the different types of weeds in a garden, it’s crucial to differentiate between various financial products and services. For instance, equity release products come in multiple forms, including home reversion plans and lifetime mortgages, each with its unique set of features and implications.

Factors to Consider Before Opting for Equity Release

Japanese Knotweed and Property Value

One unexpected factor that can affect a property’s value and therefore the amount that can be released through equity is the presence of Japanese knotweed. This invasive plant, known for its rapid growth and ability to damage buildings, can significantly devalue properties. Before considering equity release, homeowners should check for signs of Japanese knotweed damage and consider professional removal if detected.

Future Property Plans

Considering future property plans is essential. Homeowners looking to downsize or move to properties in areas like Knott End may find that selling their current property and purchasing a cheaper one might be a more economical way to release equity than a lifetime mortgage.

Seeking Expert Advice

Choosing the Right Financial Institution

It’s essential to research and approach reputable financial institutions when considering equity release. Established entities like the Chelsea Building Society branches have financial advisors who can provide guidance tailored to individual needs.

Legal Considerations

Legal considerations play a vital role in the equity release process. Banned practices or specific regulations, such as banned baby names in the UK, govern the equity release market. Understanding these regulations is crucial to ensuring a smooth transaction.

Impact on Family and Heirs

Equity release can impact the inheritance one leaves behind. It is essential to discuss intentions with family and understand how the decision might affect their financial future.

Japanese Knotweed and the UK Landscape

While this discussion centres on lifetime mortgages and equity release, ignoring the broader implications of issues like Japanese knotweed on the UK property market is impossible. This plant, while not directly related to financial products, is a poignant reminder of the unforeseen challenges homeowners might face. Just as homeowners need to be aware of changes in interest rates and market conditions, they must also be conscious of environmental factors that can affect their property’s value.

Identifying the Problem

Just as a homeowner would identify Japanese knotweed through images of Japanese knotweed or seek expert advice to confirm its presence, it’s essential to be vigilant and proactive in understanding financial markets. Regular consultations with financial advisors, keeping abreast of market trends, and understanding how personal circumstances can influence financial decisions are all crucial.

Moving Forward in the Financial Garden

Much like a garden, the financial world requires care, attention, and sometimes a bit of weeding. Whether navigating the complexities of lifetime mortgage interest rates, understanding equity release, or identifying the metaphorical weeds that can entangle one’s financial health, preparedness and knowledge are crucial. With the right tools and advice, homeowners over 60 and 70 can make informed decisions that serve their best interests and cultivate a secure financial future.

- Annexes or Two Kitchens Kendal

- Natwest Mortgage Annex

- Mortgages For Retirees

- No Credit Check Retirement Mortgage

- Age 50 Equity Release Broker

- Mortgage For New Build

- Lg Lifetime Mortgage

Lifetime Mortgage Interest Rates Over 60 in the UK

Deciphering the Complex World of Mortgages

A lifetime mortgage is a loan secured on your home, designed primarily for those over the age of 60. Instead of monthly repayments, the interest accumulates and is repaid, along with the loan, typically when the homeowner sells the property, moves into care, or passes away.

The Intricacies of Japanese Knotweed in Property

Just as understanding lifetime mortgages requires a nuanced approach, identifying Japanese knotweed – scientifically known as Fallopia japonica – is vital for UK homeowners. The invasive plant can impact property values and is notoriously difficult to remove.

Equity Release Rates Over 70

Understanding Equity Release

Equity release offers those over 70 a way to access the money tied up in their home. Different factors, such as the homeowner’s age, health, and the property’s value, can impact the amount of money you can release.

Impact of Japanese Knotweed Stem on Property

The robustness of the Japanese knotweed stem is symbolic of how equity rates can be resilient and robust. The presence of this plant on a property can significantly affect the amount that can be released.

The Social Implications: Japan Society and the UK

Exploring the cultural connections, the Japan Society in the UK plays a pivotal role in fostering relations. Similarly, understanding the socio-economic implications of mortgages and equity release is paramount.

Legislation and Property: Anti-Social Behaviour, Crime and Policing Act 2014

Property owners must know legislation like the Anti-social Behaviour, Crime and Policing Act 2014. This legislation can influence decisions around property and equity release.

Weeds with Blue Flowers UK and The Mortgage Landscape

Much like the diverse flora in the UK, like the weeds with blue flowers, the mortgage landscape is diverse. Different mortgage products cater to various needs, much like other plants serve different purposes in the garden.

Methods to Handle Knotweed

“How to get rid of Japanese knotweed UK” is a frequent query. Approaches range from using a strong Roundup sprayer to specialised eradication therapy. The importance of tackling this issue head-on cannot be understated, as it directly impacts the property’s value.

Exploring Japanese Houses and the Property Market

When we delve into the topic of Japanese houses for sale or garden weeds in the UK, we find a fusion of culture and nature. It’s akin to comparing Japan’s background with that of the UK’s diverse property market.

Plant Keys to Financial Decisions

Much like a plant key helps identify various plants, understanding the nuances of interest rates and equity release requires tools and guidance. Whether it’s distinguishing garden weed from a valuable plant or a Japanese knotweed root from other roots, discernment is key.

Time Differences and Mortgages

Navigating the world of mortgages can feel as challenging as adjusting to UK—Japan time differences. But with proper guidance and information, it becomes manageable.

Recognising Japanese Knotweed

Pictures, or Japanese knotweed photos, can help homeowners recognise this invasive plant. Similarly, recognising the signs of a good equity release deal or understanding changes in interest rates requires a discerning eye.

The Many Facets of Japanese Knotweed

From Japanese knotweed in winter to the unique structure of the Japanese knotweed leaf, understanding this plant’s intricacies is essential for homeowners in the UK. Similarly, the varied landscape of mortgages and equity release has its intricacies.

The Potential Benefits of Japanese Knotweed

While typically viewed as a problem, Japanese knotweed benefits some ecosystems by preventing soil erosion. In a similar vein, while there might be concerns about equity release, for many, it offers financial freedom in their later years.

From Plant Pots to Property Deals

Japanese plant pots might seem a world away from mortgages and equity release. Still, the idea is that attention to detail, whether in gardening or finance, can yield significant benefits.

Recognising Weeds and Financial Pitfalls

Just as one might ponder whether a plant is a weed or a valuable addition to the garden, it’s vital to discern between various mortgage products. The key is to fully understand one’s financial landscape, be it the tall weeds with purple flowers in your garden or the intricacies of lifetime mortgage interest rates.

Spring in Japan and New Financial Beginnings

As spring rejuvenates the landscapes in Japan, homeowners in the UK over 60 or 70 can look at lifetime mortgages and equity releases as avenues for financial rejuvenation.

- Marsden Building Society Retirement Mortgage

- Hodge Lifetime Over 75 Mortgage

- Crown Equity Release Pensioner Mortgage

- High Rise Flat Pensioner Mortgage Calculator

- Natwest Equity Release

- Post Office Over 65 Mortgage

- Penrith Building Society Pensioner Mortgage

- Mortgage For Over 65

- Nationwide Equity Release From House

- Barclays Retirement Interest Only Mortgage Maximum Ltv

- Royal Bank of Scotland Interest Only Lifetime Mortgage

- Rbs Lifetime Mortgage Interest Rates

- No Fees Equity Release

- Bad Credit Mortgage Reviews

- Tenants In Common Equity Loan

- Can Pensioners Get A Mortgage

- Newcastle Building Society Pensioner Mortgage

- Lifetime Mortgage To Buy A Flat

- YBS Lifetime Mortgage Over 55

- Aviva Equity Release Calculator

- Natwest Lifetime Mortgage Maximum Ltv

- Mortgages For Over 75s Pensioner Mortgage House

- Steel Houses Equity Release

Equity Release LTV for Equity Release Japanese Knotweed

The more elderly you are and the unhealthier you are, the more cash you can release with Equity Release Japanese Knotweed.

Canada Life Lifetime Mortgages

The common LTV ratios of Aviva pensioner mortgages over 55, Shepherds Friendly interest-only lifetime mortgages for people over 60, Leeds Building Society pensioner mortgages over 55, Skipton Building Society interest-only mortgages for over 65-year-olds, Newcastle Building Society over 60 lifetime mortgages no fees, and Progressive Building Society later life borrowing schemes over 55 are 45%, 60%, and 70%.

- Hodge Indexed Lifetime Mortgage

- Nationwide Equity Release Schemes

- TSB Equity Release Plans

- NatWest Lifetime Mortgage

- Hodge Lifetime Mortgage Flexible Drawdown Plan

- Liverpool Victoria LV Equity Release Schemes

- Lloyds Bank Equity Release Schemes

- Royal Bank of Scotland Interest Only Lifetime Mortgage

- Aviva Lifetime Mortgages

- Lloyds Bank Equity Release Schemes

- NatWest Lifetime Mortgage

- Equity Release Japanese Knotweed

- Liverpool Victoria LV Equity Release Schemes

- Equity Release Japanese Knotweed

- More to Life Flexi Choice Drawdown Lite Plan

- Nationwide Equity Release

- Royal Bank of Scotland Interest Only Lifetime Mortgage

- Saga home reversion plan

- More 2 Life Flexi Choice Drawdown Lite Plan

Successful business owners who could benefit from Equity Release Japanese Knotweed tax planning

- Butter and cheese production Reigate

- Cargo handling for air transport activities South Cave

- Retail sale via stalls and markets of other goods West Ham

- Manufacture of luggage, handbags and the like, saddlery and harness Needham Market

- Archives activities Burnley

- Support activities to performing arts Staines-upon-Thames

- Renting and leasing of media entertainment equipment Bridgwater

- Wholesale of household goods other than musical instruments n e c Bawtry

- Research and experimental development on social sciences and humanities Sandiacre

- Manufacture of optical precision instruments Winchcombe

- Combined facilities support activities Nelson

- General Secondary Education Dudley

- Activities of professional membership organizations Pocklington

- Other retail sales in non-specialised stores Southsea

- manufacture of canvas goods, sacks, etc Chipping Sodbury

- Precious Metals Production Warwick

- Manufacture of other electronic and electric wires and cables Penwortham

- Renting of videotapes and disks Wotton-under-Edge

Typical loan to values of LV= RIO mortgages over 75, More to life equity release schemes for over 55’s, One Family lifetime mortgages for people over 55, Yorkshire Building Society mortgages for over 50 year olds, Principality Building Society mortgages for pensioners over 60 and SunLife interest only lifetime mortgages for over 70s are 35%, 55% and 65%.

Pitfalls of Equity Release Japanese Knotweed Plans

A monthly payment lifetime mortgage can reduce the value of your estate. Home reversion schemes may impact entitlements to state benefits. You may need to pay an advisor’s fee, and you could have higher rates to pay with some schemes.

It is very regular to discover people searching for monthly payment lifetime mortgages, lumpsum lifetime mortgages, or home reversion plans. However, More to life like Zurich are keen to see proof of your circumstances in the form of investment statements.

Equity Release percentages of your current property value – Equity Release Japanese Knotweed

- 60% monthly payment lifetime mortgage Maximum cover Equity Release

- 60% loan to value monthly payment equity release, Aviva

- 35% LTV monthly payment equity release One Family

- 25% loan to value lumpsum lifetime mortgages Central Trust

- 40% loan to value home reversion plans Stepchange

- 25% loan to value lump sum lifetime mortgages Monmouthshire

- Equity Release Japanese Knotweed

Popular loan-to-value ratios for TSB equity release schemes for over 55s, mortgages for 60-plus pensioners, Post Office mortgages for pensioners over 60, Legal & General retirement interest-only mortgages over 60, Royal Bank of Scotland retirement mortgages over 70, and Nationwide mortgages over 70 are 50%, 60%, and 65%.

Japanese Knotweed is a nasty invasive plant introduced into the UK and has no natural predators. The plant is known to exploit existing weaknesses in properties. Applications, where Japanese Knotweed is identified, should be looked at in accordance with the following info:

CATEGORY 4 situations

Japanese Knotweed is within 7.0 metres of the main house, habitable spaces, conservatory or garage. Japanese Knotweed is causing serious damage to permanent outbuildings, associated structures drain, paths, boundary walls and fences.

An insurance-backed treatment plan must be confirmed prior to completion. The recommended remedial works don’t need to be completed prior to the release of any mortgage monies.

CATEGORY 3 effected properties

Japanese Knotweed is present within the curtilage but is more than 7 metres from the main building, habitable spaces, conservatory and/or garage and any permanent outbuilding.

Report this in the valuation together with a valuation of the property. No further investigation or action is required.

There is damage to outbuildings, associated structures, paths and boundary walls and fences and this is considered minor.

Report this in the valuation together with a valuation of the property. Further due diligence is warranted. This is to be undertaken by a Property Care Association (PCA) registered company.

An insurance-backed guarantee must cover all recommended remedial works. The guarantee must be for a minimum of 10 years, be property specific and transferable to subsequent owners and any mortgage in possession.

An insurance-backed treatment plan must be confirmed prior to completion. The recommended remedial works don’t need to be completed prior to the release of any mortgage monies.

CATEGORY 2 residential properties

Japanese Knotweed is not found within the property’s boundaries but on a neighbouring property or land.

It is within 7 metres of the subject property’s curtilage but more than 7 metres away from the main building, habitable spaces, conservatory and/or garage, and any permanent outbuilding.

CATEGORY 1 Knotweed issues

Japanese Knotweed is not seen at the property, but it can be seen on neighbouring property or land that is more than 7 metres away from the curtilage of the subject property.

Popular retirement loan offerings are TSB mortgages for people over 50, Barclays Bank help-to-buy mortgages for people over 60, NatWest pensioner mortgages for people over 70, Legal & General equity release schemes, and Nationwide mortgages for people over 60.